The Importance of Monthly Bookkeeping for Small Businesses

Share On Socials Now

In the highly competitive world of small businesses, maintaining precise financial records is essential for long-term success. Monthly bookkeeping is a strategic practice that ensures accurate financial management and provides a foundation for informed business decisions. Here’s why consistent monthly bookkeeping is indispensable for small businesses.

Ensuring Financial Accuracy and Transparency

- Timely Financial Records

Monthly bookkeeping ensures that all financial transactions are recorded promptly and accurately. This habit reduces the risk of errors and discrepancies, enabling businesses to maintain clear and transparent financial records. Accurate bookkeeping helps in tracking every penny that flows in and out of the business, which is crucial for understanding the financial position at any given time.

- Better Cash Flow Management

Regular bookkeeping helps monitor cash flow effectively. By keeping an eye on incoming and outgoing funds, businesses can ensure they have sufficient cash reserves to meet their obligations and seize growth opportunities. Effective cash flow management involves projecting future cash needs and ensuring that the business does not run into liquidity issues. Timely bookkeeping helps in identifying potential cash shortages in advance and allows business owners to take corrective measures such as arranging for short-term financing or cutting unnecessary expenses.

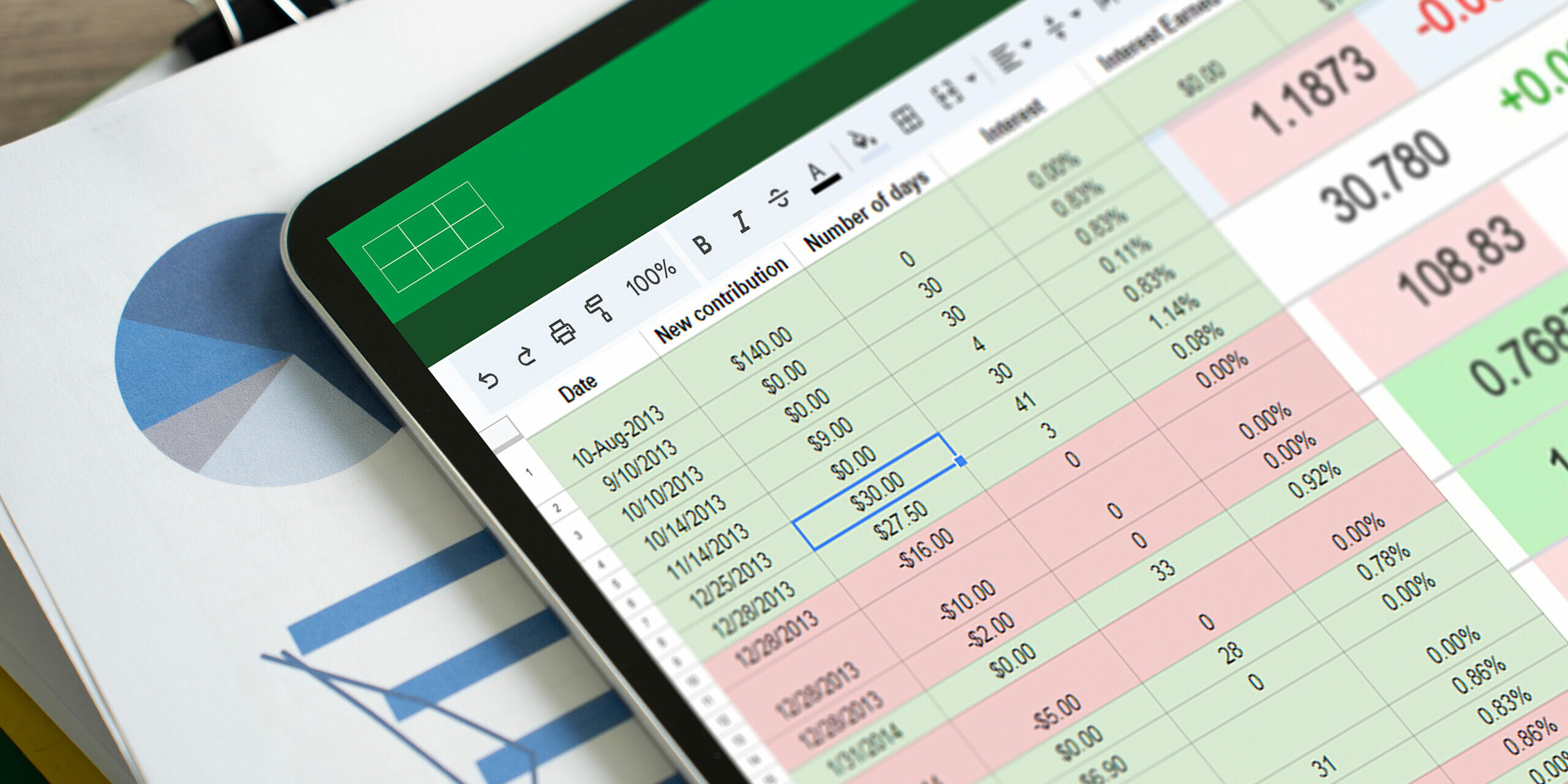

Facilitating Informed Decision-Making

- Detailed Financial Reports

With up-to-date bookkeeping, small businesses can generate detailed financial reports, such as income statements, balance sheets, and cash flow statements. These reports provide insights into the business’s financial health, aiding in strategic decision-making. Accurate financial reports help in evaluating the performance of different business segments, understanding the profitability of various products or services, and making data-driven decisions to improve overall business performance.

- Identifying Trends and Patterns

Consistent bookkeeping allows businesses to identify financial trends and patterns over time. This analysis helps in understanding seasonal fluctuations, customer behavior, and other critical factors, enabling proactive business planning. For instance, a business may notice that sales peak during certain months and dip during others. Understanding these trends can help in optimizing inventory management, marketing efforts, and staffing requirements.

Streamlining Tax Preparation and Compliance

- Simplified Tax Filing

Monthly bookkeeping simplifies the tax preparation process by ensuring all financial information is organized and readily available. This practice reduces the stress and time involved in tax filing, minimizing the risk of errors and penalties. By maintaining accurate records throughout the year, businesses can quickly provide the necessary documentation to their tax advisors, ensuring timely and accurate tax returns.

- Regulatory Compliance

Keeping accurate and up-to-date financial records ensures compliance with tax laws and financial regulations. This proactive approach mitigates the risk of non-compliance and associated fines, safeguarding the business’s reputation. Compliance with financial regulations is essential for avoiding legal issues and maintaining good standing with regulatory authorities. Regular bookkeeping ensures that all transactions are recorded in accordance with applicable laws and standards.

Enhancing Operational Efficiency

- Focus on Core Business Activities

By maintaining regular bookkeeping, small business owners can focus more on core business activities. Accurate financial records provide peace of mind, allowing entrepreneurs to dedicate their time and energy to growth and innovation. Delegating bookkeeping tasks to professional accountants can further free up valuable time that business owners can invest in developing new products, expanding customer base, and exploring new market opportunities.

- Efficient Financial Management

Monthly bookkeeping helps in managing expenses, monitoring budgets, and controlling costs. This efficiency ensures that resources are allocated appropriately, supporting sustainable business growth. Effective financial management involves setting realistic budgets, tracking actual performance against budgets, and making adjustments as necessary. Regular bookkeeping provides the data needed to make informed financial decisions and optimize resource allocation.

Supporting Strategic Financial Planning

- Informed Budgeting

Consistent bookkeeping provides a reliable financial foundation for creating realistic budgets. Businesses can forecast future revenues and expenses more accurately, leading to more effective financial planning. A well-prepared budget serves as a roadmap for achieving business goals and managing financial risks. Monthly bookkeeping ensures that budgets are based on accurate and up-to-date financial information, improving the reliability of financial plans.

- Risk Management

Regular financial reviews through monthly bookkeeping help in identifying potential risks and challenges early. This foresight allows businesses to take corrective actions promptly, minimizing negative impacts on operations. Identifying financial risks such as declining sales, increasing costs, or cash flow issues is crucial for maintaining business stability. Monthly bookkeeping enables timely detection of such risks and allows business owners to implement strategies to mitigate them.

Conclusion

For small businesses, monthly bookkeeping is more than just a routine task; it’s a strategic tool that ensures financial accuracy, supports informed decision-making, streamlines tax preparation, enhances operational efficiency, and bolsters strategic financial planning. Implementing regular bookkeeping practices empowers business owners to navigate their financial landscape with confidence, fostering growth and success.

If you need assistance with bookkeeping or other accounting services, our firm specializes in supporting small businesses with comprehensive financial solutions tailored to your unique needs. Contact us today for a consultation and learn how we can help you achieve your business goals.